Table of Content

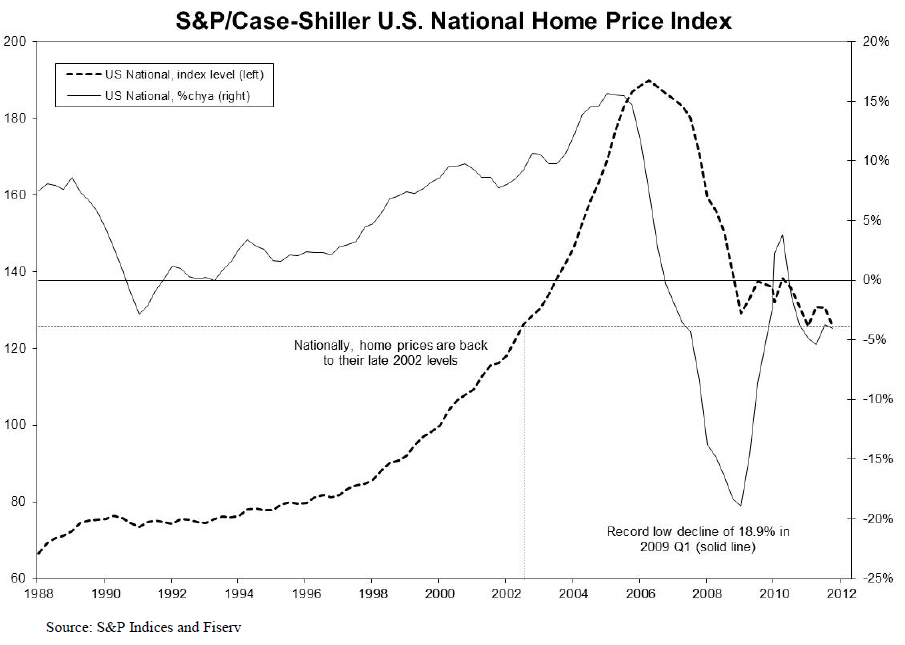

As a result, prices might not continue to plunge down as much as some projections anticipate— as the available inventory of homes on the market is constrained. The Case-Shiller index was also known as S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index. It is a group of indexes that measures the price changes in single-family houses based on a three-month average released by S&P’s CoreLogic division. The composite indices are updated on the last Tuesday of every month, but with a lag of two months. The national Case-Shiller Home Price Index rose 10.6% year-over-year in September, down from the rate set in August.

As a Premium user you get access to background information and details about the release of this statistic. As a Premium user you get access to the detailed source references and background information about this statistic. In December, all 20 cities reported increases before and after seasonal adjustments. API GATEWAY Direct access to our data from your apps using any programing language.

House Price Indexes

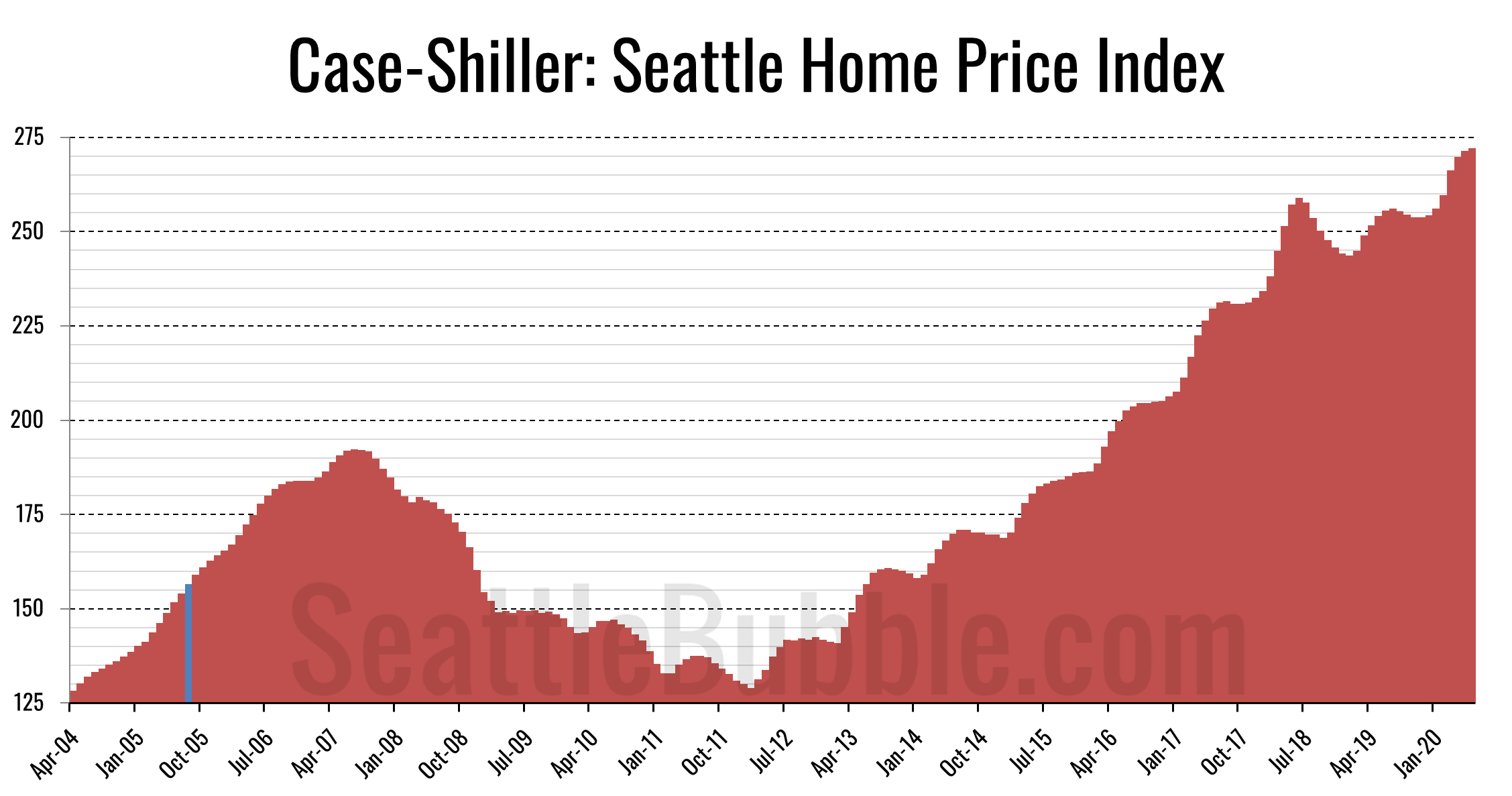

The S&P CoreLogic Case-Shiller 20-city home price index in the US increased by 10.4 percent from a year earlier in September 2022, the least since December 2020 and below market forecasts of a 10.8 percent increase. It has been the fifth consecutive deceleration in the growth as demand for housing has been hit by rising borrowing costs, low housing inventory, and stubbornly high inflation. Still, Miami reported the highest gain (24.6 percent), followed by Tampa (23.8 percent), and Charlotte (17.8 percent). On the other hand, San Francisco and Seattle had the weakest gains.

Yes, the Case-Shiller index adjusts the house prices with the rising inflation. It records the actual selling price of the house or purchase price for an owner. This record helps eliminate people’s general perception or misinformation about the extremely high or rising prices of single-family houses or real estate properties. Thus, by recording the accurate increase or change in prices, the Case-Shiller index assists in determining actual cost and inflationary pressures leading to changes in the cost of a house. Additionally, the index allows analysts to study changing housing prices in different geographical areas of a country. The influencing factors include interest rates, changing incomes or revenues, population shifts, infrastructure, and other local market changes.

Other statistics on the topicThe Great Recession Worldwide

All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. Actual returns may differ significantly from, and be lower than, back-tested returns. Past performance is not an indication or guarantee of future results. This back-tested data may have been created using a “Backward Data Assumption”. For more information on “Backward Data Assumption” and back-testing in general, please see the Performance Disclosure. Case-Shiller numbers are 3-month moving averages so the January number is really the November-January average.

It analyses data for single-family properties that have undergone two or more consecutive sales transactions. Additionally, S&P records only arms-length transactions of properties. However, the national home price index calculation considering nine census regions of the U.S. takes place quarterly and gets released on thelast Tuesdayof February, May, August, and November. The rate of year-over-year price increases has sharply slowed since reaching a peak of 21.2% in April. The S&P/Case-Shiller Index, however, is value-weighted, so more expensive houses have a greater influence on estimated price changes.

Statistics on Housing market in Germany

This is the first time since March 2011 that the FHFA index has seen two consecutive months of decline. Despite running 3 months behind, the Case-Shiller Home Price Index remains the most accurate measure of house price appreciation. Case-Shiller has data for 16 of the 20 largest metropolitan areas in the United States. Data isn’t available for, or Case-Shiller doesn’t follow, Houston (#5), Philadelphia (#8), Riverside (#13) or St. Louis (#20). The Case-Shiller graphics on this page show house price data for the rest of the top 20 metros plus Charlotte (#23), Portland (#25), Las Vegas (#28), Cleveland (#33), and the USA as a whole.

Perhaps in the future, I’ll use that state-level quarterly data to estimate personal income at the metro level for the most recent months. But that’s would be a big project to forecast Per Capita Personal Income by metro by month. September brought about high interest rates and slowing sales, which continued to slow home price growth annually. While buyers are stepping aside waiting for more affordable prices and rates – causing the slowdown on price growth – would-be sellers are sticking their ground and holding tight to the inventory they currently own.

Annual growth was slower in September than August in both the 20-city index (to 10.4% from 13.1%) and 10-city index (to 9.7% from 12.1%). The S&P CoreLogic Case-Shiller U.S. National Home Price Index® rose 10.6% year-over-year in September (non-seasonally adjusted), down from 13.0% in August. Nevertheless, you might be interested in looking at some income data to get a feel for the data. I wanted to see how the real estate booms developed from the very beginning so I moved the Case-Shiller baseline year back to 1995 from 2000.

The S&P CoreLogic Case-Shiller 20-city home price index in the US increased only 16.1% year-on-year in July of 2022, decelerating for a third consecutive month, and below market forecasts of a 17% rise. It is also the smallest increase in home cost since April last year, with all 20 cities reporting deceleration, as the Fed continues to move interest rates up, making mortgage financing more expensive. Prices in Tampa (31.8%), Miami (31.7%), and Dallas (24.7%) rose the most while Minneapolis (9%), Washington (9.4%), and San Francisco (10.8%) recorded the smallest increases.

Annual appreciation slowed in both the 10- and 20-city (non-seasonally adjusted) indices. The annual gain in the 10-city index fell from 12.1% in August to 9.7% in September and for the 20-city composite index from 13.1% to 10.4%. From August to September the national index fell to -0.8%, while the 10- and 20-city indices were down -1.2% and -1.2%, respectively. In addition, average and median house prices are more affected by the mix of houses sold.

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in September. Miami led the way with a 24.6% year-over-year price increase, followed by Tampa in second with a 23.8% increase, and Charlotte in third with a 17.8% increase. All 20 cities reported lower price increases in the year ending September 2022 versus the year ending August 2022.

No comments:

Post a Comment